Remittance Flows, BOP: Mapping out Development Outcomes

The undergoing developments that have been touching the remittances market have un-shrouded new shifts for development strategies, where increased attentions from private sector corporations in the banking and financial services are trying to tap into this economic boom, through the integration of technological tools and financial mechanisms to streamline capital flows and direct investments.

Ok, these arguments are close to C.K. Prahalad’s theory in respect to market-based transactions, and bottom-line narratives, where the role of the poor in any market-given transaction is viewed as an active economic agent (for more on that, see Christine Bower’s Post on PSD Blog) enshrined around three building blocks, which are:

- The significance of purchasing power at the Bottom of the Pyramid

- Selling to the poor as a strategy for growth and wealth creation for them

- Large Multi-national corporations have to be leaders and catalyst for change in this process

As a matter of fact, the IDB (Inter-American Development Bank) has been developing a wonderful database that will map out for Latin-America and the Caribbean (LAC), remittance flows and historical data for the region, quite interesting though: Migrant-Remittances as a Development Tool

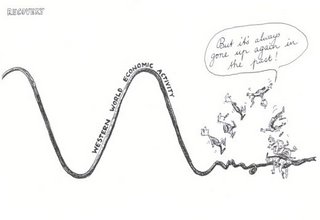

* Cartoon: Courtesy of Nicholson Cartoons